When Do Credit Cards Report Balances / 3 Easy Steps to Remove a Foreclosure from Your Credit Report | Paying off credit cards, Balance ...

When Do Credit Cards Report Balances / 3 Easy Steps to Remove a Foreclosure from Your Credit Report | Paying off credit cards, Balance .... Credit card companies lend you money with the anticipation you will repay it at the end of the next billing cycle. They're easier to get because they require a security deposit to open the account. You have a credit utilization factor, which is the amount of credit you've used compared with the amount of credit you have available. It depends on your situation. Feb 04, 2021 · to make matters worse, having high balances on credit cards makes your credit score go down.

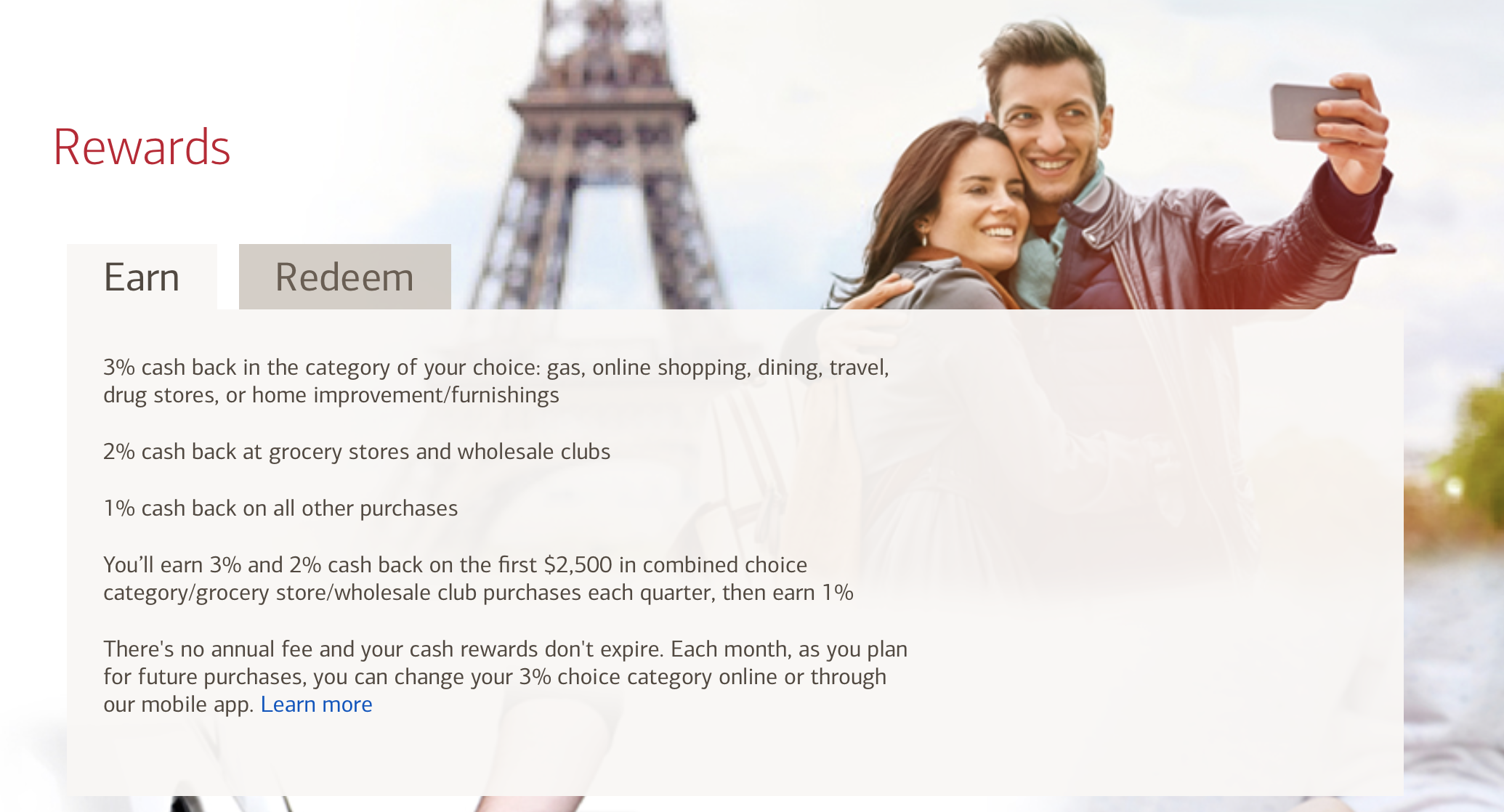

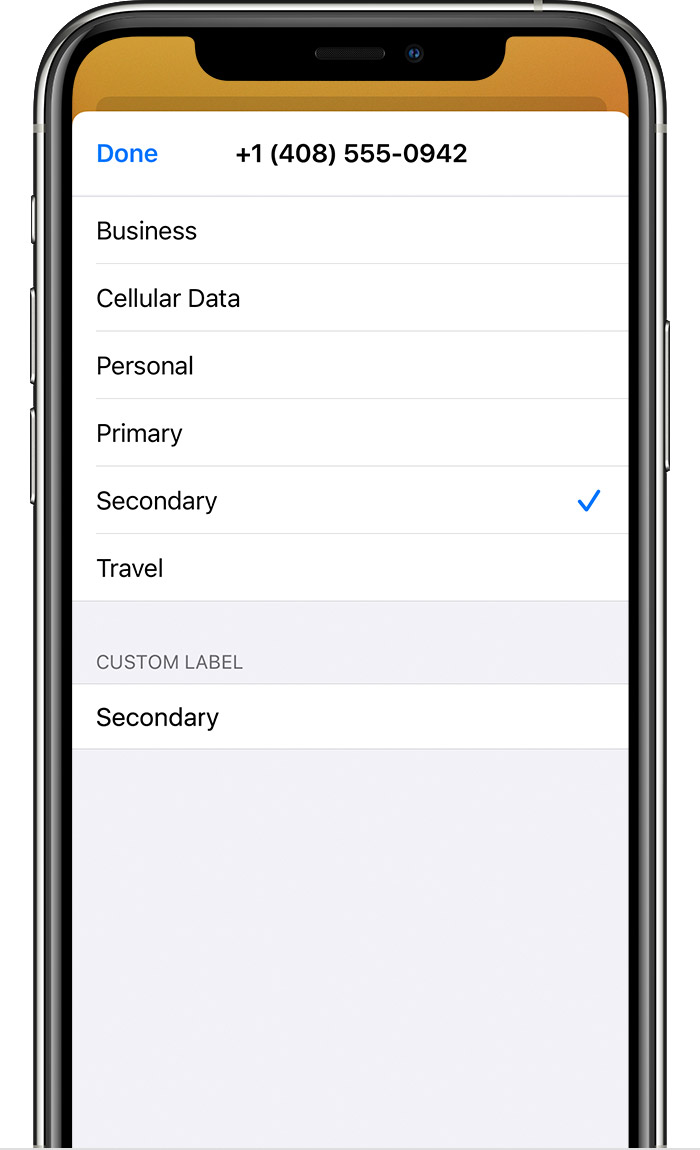

Jul 23, 2021 · rewards credit cards offer a way for you to get value from your credit cards in the form of points, miles or cash back for your purchases. Jul 20, 2021 · secured credit cards are better for small business owners with bad credit. They're easier to get because they require a security deposit to open the account. As long as you pay your business card on time and avoid high balances, having a business card that appears on your personal credit reports with equifax, experian and transunion should not be a problem, and may even help your credit scores. The three nationwide credit bureaus generally update your account as soon as they receive new information, meaning your credit scores can change.